The City Council’s Audit Committee chair MARK “NO” BRAIN’s presentation of his yearly report to Full Council in July proved to be hugely entertaining for public and councillors.

The City Council’s Audit Committee chair MARK “NO” BRAIN’s presentation of his yearly report to Full Council in July proved to be hugely entertaining for public and councillors.

Sporting a dazzling Salvador Dali tie, perhaps to highlight the surrealism of it all, a visibly wriggling, flustered and confused No Brain finally had to come up – publicly – with an explanation as to what’s been going in the council’s MARKET SERVICE for the last three years and what his committee’s done about it. And what a gem of an explanation we got!

No Brain confirmed that at least £41k was indeed MISSING from the service. Although he creatively upcycled and rebranded this embarrassing and inexplicable disappearance of cash from his description last month of it as “A DEBT” (owed by no one) to a “NOT QUITE A LOSS“!

He then claimed – WITHOUT ANY EVIDENCE – that the money definitely hadn’t been “misappropriated” and this “not-quite-a-loss” was the result of “mismanagement and bad accounting”.

Raising the immediate question of what the hell is “BAD ACCOUNTING” and how does it make £41k disappear into thin air?

Can we all do that? Or is it only city council middle managers who are allowed to run a set of accounts so shite that CASH CAN JUST RANDOMLY DISAPPEAR without any explanation and then get formally explained away by an idiot in a Salvador Dali tie as a “not-quite-a-loss”?

At least we’ve all now learned how to rip cash off the council. Just generally fuck up your accounts by inaccurately recording any cash going into those accounts; pocket the cash; forget to reconcile cash in the bank with your accounts and wait for the council’s Internal Auditors to formally sign it off as a “not-quite-a- loss” due to “mismanagement”!

This is all a change of tune from April, however, when finance bosses led by their Service Director Peter “What Crisis?” Gillett told No Brain and his committee of gullibles that the missing cash was “NOT thought to be the result of misappropriation or BAD MANAGEMENT”

What’s changed since April? When did they decide that it was the fault of BAD MANAGEMENT? Are we seeing the wheels slowly coming off a poorly executed cover-up here as the excuses run out?

There’s plenty more questions to ask about all this too. Why are the council announcing this “not-quite-a-loss” now while a formal, FORENSIC AUDIT, announced in April, is still taking place? Until this audit is complete can the scale of their “not-quite-a-loss” really be officially confirmed?

So are council bosses still conspiring? This time to disguise any potentially bigger “not-quite-a-losses” from us?

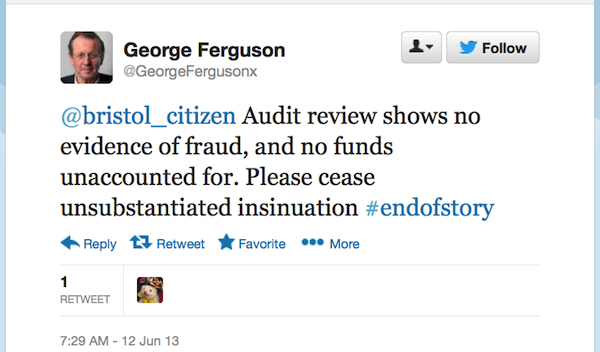

An explanation is also needed about formal statements made on this matter over the summer of 2013 when both Mayor Bent Accounting and his sidekick Sir Gus Hoyty-Toyty publically insisted NO MONEY WAS MISSING from the Market Service.

Another, further, outright lie came in 2012 when the BBC were assured ON THE RECORD by the council’s PR department that NO MONEY WAS MISSING in markets and the whole episode was entirely down to an “antiquated” accounting system (even though the system was only a few years old!)

Council PR boss, Tim “Zombie” Borrett then briefed this exact same LIE to the Nazi Post in March 2014 when the bent little fucker bravely tried to blame The BRISTOLIAN for the suicide of his dubious colleague, Facilities boss Tony Harvey. The man DIRECTLY ACCOUNTABLE for the accuracy and coherence of the Market Service’s accounts.

At that time Zombie Borett was PEDDLING A LINE for shadowy senior council bosses and the mayor that butter wouldn’t melt in the mouths of any Market Service managers. They were poor innocents and unfortunates who had been horribly hounded by unscrupulous forces on the internet!

Zombie Borett also “forgot” to mention during his briefing to the Post that any money had gone missing in the Market Service. Now the very same markets bosses Zombie was aggressively defending are being fingered by senior figures within the council for “MISMANAGEMENT” and “BAD ACCOUNTING“.

It’s all slowly coming out isn’t it?

That Mark “No Brain” explanation of missing Markets money to Full Council on 21 July 2015 in full:

The issue of markets has been of some public interest in, er, some quarters.

Um (pause). Basically (pause). Um, er, we had an issue around management in the markets and the, er, loss, er, or not quite the loss (pause). The fact that £41,000 of marketing money. Er, rather markets money was unaccounted for.

Um (pause). Internal audit have investigated. They are of the view they will never find the £41,000. Um, er. They are of the view it hasn’t been misappropriated. It was just mismangement and bad accounting and that’s the reason we can’t find it. Rather than it’s actually been stolen … um.

Elsewhere in the latest markets report we’re assured that the OLD BENT MANAGEMENT of the service has now been moved on in favour of a new, young all-singing, all dancing team.

Elsewhere in the latest markets report we’re assured that the OLD BENT MANAGEMENT of the service has now been moved on in favour of a new, young all-singing, all dancing team.