CAN’T STAND UP TO MANAGERS – CAN’T PROTECT WHISTLEBLOWERS…

Back in mid-January, another meeting of the Bristol City Council’s crap Audit Committee offered up yet more shocking revelations of FINANCIAL MISMANAGEMENT AND SLEAZE in the seedy corridors of corrupt power at Shitty Hall.

Back in mid-January, another meeting of the Bristol City Council’s crap Audit Committee offered up yet more shocking revelations of FINANCIAL MISMANAGEMENT AND SLEAZE in the seedy corridors of corrupt power at Shitty Hall.

The committee’s in-depth fraud reports (which have proved to be a hugely embarrassing feature of the last few meetings), have been quietly ditched. But another report catches the eye. With the unpromising title of ‘Internal Audit Compliance with Public Sector Internal Audit Standards’, it reveals the extent to which our council has operated for the benefit of bent bosses and against the interests of whistleblowers.

The report identifies “a few specific areas…where currently Internal Audit arrangements do not fully conform with the public sector Internal audit standards requirements”. Or, in other words, areas where the committee and its FEEBLE INTERNAL AUDIT TEAM have screwed up.

Top of the list is, “The Chief Internal Auditor should report to an organisation level equal or higher to the corporate management team and must be sufficiently senior and Independent to be able to provide credible constructive challenge to senior management.”

So the Chief Internal Auditor should report directly to the council’s Chief Executive? This has never happened. The Chief Auditor always reports to the Head of Finance – a level below corporate management. Until recently, when he scarpered sharpish, Head of Finance was Freemason Peter Robinson, who SPIKED ANY INVESTIGATION into the Markets Service and did nothing to discourage the victimisation of a whistleblower there.

We know he also once spiked an investigation into the dubious procurement of a fleet of Mercedes vans. On that occasion he victimised – then attempted to sack – an investigator in Internal Audit who uncovered and produced a report on that particular procurement scam.

Chief Internal Auditors have been NEUTERED and left powerless for years – and it’s a fact they admit. Last year in an email to a senior trade unionist the head of Internal Audit’s fraud unit, Andea ‘Chocolate Teapot’ Hobbs, admitted that they “cannot provide any assurances as to how management will respond if a whistleblower makes him/herself known to management as a whistleblower (as happened in the circumstance I believe you are referring to).”

The “circumstance” referred to is the way that Tony Harvey and his bosses responded to whistleblowing by victimising and bullying the whistleblower out of their job – apparently under the nose of Ms Hobbs.

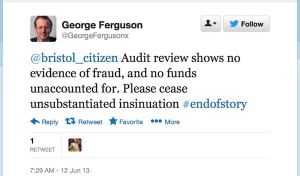

Let’s face it, if you’re unable to stand up to a soppy little Facilities Manager and stop them doing over a whistleblower, or to call that manager out for being unable to account for £165,000, then the idea you can provide “a credible constructive challenge to senior management” is laughable.

The reverse is true. Middle managers have been able to IGNORE Internal Auditors with impunity, stamp on whistleblowers and do whatever they like with our money for years.

What a shambles.