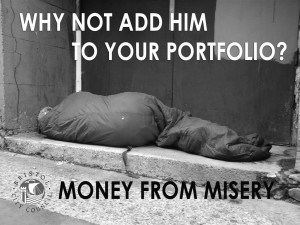

BCC offers venture capitalists 3-6% profit out of its Property Fund for the homeless

BCC offers venture capitalists 3-6% profit out of its Property Fund for the homeless

Bristol’s homeless are now so thick on the ground that you can’t go past a public park without seeing shabby tents inhabited by those turfed out by housing cutbacks and ever-rising rents.

HRH Lord Ferguson’s response to this is to hand £5m into a joint property purchase fund with an organisation called Real Lettings – consisting of Resonance (a fund/asset management company), and St. Mungo’s housing association/homeless charity.

Big Society Capital, the government’s private investment fund will then invest a ‘matching’ £5m into this property fund’s purchases. These homes will then be rented out to 70-80 households of the ‘unintentionally homeless’, consisting of 80% families and 20% singles.

These new deserving poor are given no more than 2-3 years with St Mungo’s to “move up through the homelessness pathways” and earn the ‘privilege’ of renting independently in the private sector. Their progress presumably being sustained on zero-hours minimum wage jobs?

All this is contained in a public document, ‘Executive Summary of Agenda Item 7’, signed off on 3 November by HRH and rubber stamped by his ‘cabinet’: court flunky councillors Gollop (Con), Cook (LibDem), Radice (Green), and Massey (Lab). The Council’s intention – as written – is to ‘support homelessness’ (sic), by joining the Real Lettings’ national scheme as outlined above.

Much of the document is filled with cost projections, risk management tables and colourful graphs, with sub-headings such as ‘sensitivity analysis’, ‘capital appreciation’ and ‘cash yield’.

And a ‘net target return’ of 3% plus profit is anticipated for the investor, even after the Council, Resonance and St. Mungo’s have taken their cuts. It is explained that this route will be ‘significantly cheaper’ than lodging the homeless, as at present, in private B&Bs.

It is also disconcertingly stated that The Fund is an ‘unregulated collective investment scheme’, which disqualifies it from protection normally offered by the Financial Conduct Authority (FCA).

Big Society Capital is chaired by Ronald Cohen of pensions collapse fame, who along with hsome friends in 2000 disappeared with the pensions of 544 long service workers from British United Shoe Machinery (BUSM). In total, £81 million vanished from three pension funds: Dexion, BUSM, and USM Texon… All faster than you could say Abracadabra.

A comment by Ashok Kumar MP on the unresolved scandal involving Big Society Capital’s chairman is worth quoting in full: “I think these people need flogging. I feel so angry on behalf of decent upright citizens robbed of their basic human rights… These are greedy, selfish capitalists who live on the backs of others.”

But of course, having such a person at the helm investing in a local homeless fund for profit will not be bothering Lord Red Pants or his sycophantic team.