This month’s Bristol City Council entry for ‘BRITAIN’S WORST LOCAL AUTHORITY CONSULTANTS’ REPORT’ comes courtesy of Nabma Market Place’s (NMP) report into St Nicholas Market. Accuracy, it seems, is not NMP’s strong point while making proposals that could WRECK LIVELIHOODS. “Within St. Nicholas market,” we’re told authoritatively, “there are three individual segments. Each area has 50 trading units.”

Er, except, later in the report, every stall in every segment is identified “in chronological [sic] order”, with each business and its rental charge identified with NO REGARD FOR PRIVACY, and the total is 49 stalls. Is the market two-thirds unoccupied? No – “STALL OCCUPANCY RATES ARE NEAR 100%” – we’re told. This is an error of some magnitude then. An error that gets repeated. “The Glass Arcade offers 50 UNITS principally for the sale of fast food,” we’re unreliably informed, making any attempt to excuse the inability of these consultants to count as a typo or a transcription error tricky.

NMP are similarly CONFUSED ABOUT FINANCES. “Annual income generated from the markets and docks estate services through market and concession licence fees, event, promotional and filming site fees is £750,000,” we’re told. Then we’re assured, “the Council currently generates a surplus of approximately £315,000 pa.”

However, finance information in the report suggests that this claim is BOLLOCKS. Gross yearly rent recorded for St Nicks is £115k. While, even, if we accept that every street market stall on Corn Street is occupied on every market day for the maximum charge of £37 then that would earn around £200k. Making turnover about £325K A YEAR. A figure suspiciously close to £315k. Do the council and their consultants know the difference between TURNOVER and SURPLUS? And where did they find their £750k turnover figure?

The problem here is that this flawed report proposes MAJOR CHANGES. One proposal is to RAISE RENTS. We’re told, “there are many inconsistencies in the rental structure. Such anomalies are historic and are a result of several years rent negotiations with individual traders.”

Swiftly glossing over these odd “negotiations” between council bosses and individuals over lawful charges, NMP propose to “resolve inconsistencies in the rental structure” with, er, an INCONSISTENT RENTAL STRUCTURE! They propose: Exchange and Covered market rents remain UNCHANGED; café rents remain UNCHANGED; Glass Arcade rents increase to “A REALISTIC COMMERCIAL VALUE“; a SEPARATE RATE is introduced for fast food traders; rents at Market Gate remain UNCHANGED; trader Spice Up Your Life’s rent is INCREASED.

What’s consistent about this? Especially when the report says, “in reviewing the Exchange and Covered market rents there is no consistency in the fees and charges”. An INCONSISTENCY that, apparently, can remain.

NMP’s second proposal is the real BOMBSHELL for traders, however: “Without doubt the popularity of food and Bristol City would greatly benefit from having a really high quality food hall. Such a facility, located in the Exchange, would provide a unique facility to the City, enhance the market area and complement market activity in St. Nicholas Market. A food hall … would be a fabulous asset to the City. The market would become the central hub for high end food.”

Look out! They’re gonna gentrify our market using a hookie report.

Tag Archives: Markets

PRIVATE SECTOR EFFICIENCY WATCH

Spunkface

City Council Property Services Director, Robert “Spunkface” Orrett, finally abandoned his local authority sinking ship in September for an executive lifeboat in Filton. Here, a LUCRATIVE CONTRACT appeared with Malaysian corporate, YTL.

YTL are the firm who want to build Bristol’s arena in Filton with public money and who, no doubt, will find Spunkface’s city council CONTACT BOOK and INSIDER KNOWLEDGE of developing an arena in Bristol very useful indeed.

Those with longer memories, may recall Spunkface arrived at Bristol City Council in the autumn of 2012 from corporate property firm BNP Paribas as the man who was going to bring “private sector efficiency and discipline” to the council’s STRUGGLING and UNDER-POWERED Property Services Department.

He also brought along an UNLAWFUL private consultancy gig with BNP Paribas, which he didn’t give up for over a year, breaking all known codes of conduct for public servants. However, for some reason, this conduct was OVERLOOKED by senior council bosses and councillors who are supposed to rigorously defend the integrity of our public services.

When Spunkface departed in the autumn, his department – largely run by a revolving door of interims and consultants who couldn’t give a toss – was announcing over £7million in UNACHIEVED SAVINGS; an OVERSPEND of £2million and was engulfed in MANAGEMENT CHAOS. Meanwhile, on Spunkface’s watch, a number of financial and bullying SCANDALS had emerged across his department.

These SCANDALS in markets, security services and the Harbour Office were all brushed under the carpet by Spunkface while he SINGULARLY FAILED to make any progress in increasing income from the council’s valuable property portfolio as he had been employed to do. Although plenty of city council property was handed over FOR FREE to corporate property guardian firms to earn big money from EXPLOITING the homeless and vulnerably housed.

Now that Spunkface has departed, we learn that discussions are taking place at a senior level in the council about OUTSOURCING the management of the council’s Property Services to the PRIVATE SECTOR to bring – wait for it – “private sector efficiency and discipline” to the useless department!

Who would ever have guessed that a manager brought in from the private sector would achieve nothing except to so thoroughly trash a local authority department it needed to be outsourced to the, er, private sector?

MARKETS: THE LATEST LIE

It’s the story that never dies! Minutes finally published in late June for a meeting that took place on 24 April reveal that the council have discovered £41k in CASH is MISSING from their Markets Service. Just like The BRISTOLIAN’s been saying all along!

It’s the story that never dies! Minutes finally published in late June for a meeting that took place on 24 April reveal that the council have discovered £41k in CASH is MISSING from their Markets Service. Just like The BRISTOLIAN’s been saying all along!

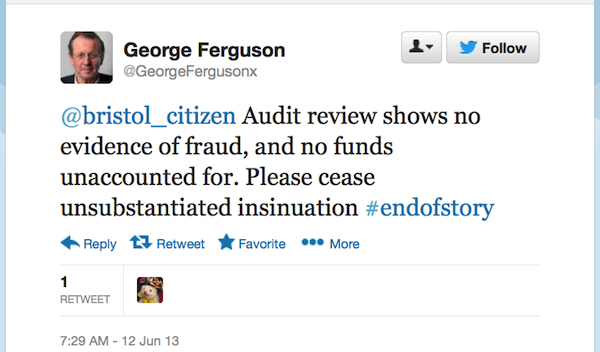

But how can this be? Didn’t Mayor Cover-Up and his trusty sidekick, Sir Gus Hoyty-Toyty, publicly assure us all in 2013 that NO MONEY WAS MISSING from Markets and that the Bristolian needed to stop making unsubstantiated insinuations? #endofstory!

Well, that’s now officially a load of bollocks – and not #endofstory at all – according to Mayor Foot-in-Mouth’s own Audit Committee. They heard ADMISSIONS from the council’s over-promoted bog cleaner-in-chief Charlie “Gutbucket” Harding, the Chief Internal Auditors and the council’s finance boss, Peter “What Crisis?” Gillet, that, despite strenuous DENIALS stretching back over three years, at least £41k of CASH has in fact gone astray.

Not that sensitive council bosses put it quite as crudely as that. Instead they referred to “A DEBT” of £41k. Albeit a rather unusual cash “debt” that was authorised by no one and is owed by no one!

Indeed, most of us would say that this money is “unaccounted for” or “missing” or, even, “STOLEN”. But what’s some deliberately misleading SEMANTICS between senior council finance managers covering arse and councillors?

This motley collection of expert finance bosses, who have taken just three years to uncover a “debt” that was first pointed out to them by a whistleblower all that time ago, were also quick to assure councillors that the “debt” was “not thought to be the result of MISAPPROPRIATION or BAD MANAGEMENT“.

Really? So how did the cash disappear then? Did it float out of a safe and up to heaven one day? Did it spontaneously combust somewhere in St Nicks Market? Or perhaps their Market safe is a portal to another dimension and our money now lies safely beyond everyone’s reach?

These latest excuses from council bosses are RIDICULOUS. How the fuck can £41k of public money not be accounted for and it not be the fault of anyone? Do they take us all for fools?

Indeed, when pressed, the council’s USELESS pair of Chief Internal Auditors were forced to admit that they were “not able to determine what had happened to the money”! So quite how the pair of COVER-UP merchants can then state categorically that it’s nothing to do with “misappropriation or bad management” is anyone’s guess. Mainly theirs!

Mayor Cash Loss’s Tory cabinet finance chief, Geoff “Cods” Gollop, was even forced to wade in at the meeting. Blustering that “accounting systems have been changed to ensure that this situation is rectified for the future”. But what “situation” is he referring to? How exactly do you rectify an INEXPLICABLE OCCURRENCE?

At least councillors on the Audit Committee, after spending three years staring gormlessly into space listening to increasingly WILD EXPLANATIONS from finance bosses while their Markets Service was ripped off, may have finally woken up.

They’ve demanded a further report from their BENT finance chiefs by the autumn and demanded an update on the so-called “debt” for their next meeting.

But what happens next? Will anyone call the POLICE to investigate where our money is as it’s obvious our council has either no idea or is covering up what’s happened to it?

YOUR MONEY NOT SAFE IN THEIR HANDS

Bristol City Council’s quarterly internal audit report into its financial management is out and the news, as usual, is uniformly bad. The council’s own assessment of its management of our money remains ‘of concern’ – as it has been for over two years now. Will it ever end?

Bristol City Council’s quarterly internal audit report into its financial management is out and the news, as usual, is uniformly bad. The council’s own assessment of its management of our money remains ‘of concern’ – as it has been for over two years now. Will it ever end?

Highlights in this dismal report in to serial organisational incompetence include:

“Non-compliance with Procurement Regulations is wide spread”

In other words contacts are dished out to friends, family, acquaintances, former employees, people from the golf club etc.

“Poor contracts monitoring has been identified as the cause of large overspends”

Once they’ve awarded contracts to their mates nobody bothers to enforce the terms of the contracts. Any old crap’s good enough for Bristolians

“Failure to monitor adherence to contracts [means] poor value for money”

Not bothering to enforce the terms of these contracts is costing us all dear except the lucky recipients of these unmonitored anything-goes contract arrangements.

“Inadequate strategic overview of engagement and use of consultants”

Highly paid consultants are employed at the drop of a hat to do the work that the highly paid managers aren’t capable of doing.

“Internal Audit recommendations are not actioned within a reasonable time frame”

When dodgy financial arrangements and deals are uncovered fuck all is done about it.

Bank Reconciliation and Cheque Control – OF CONCERN

The amount of cash and money that should be coming in to the council is not cross checked with the amount of cash and money that is coming in to the council. A free-for-all for embezzlers!

“Markets Operation – OF CONCERN”

Almost one year after £165k ‘disappeared’ without trace from the Markets Service and, still, nobody knows what’s going on with our money in that department; nobody’s doing anything about it and nobody’s responsible.

“Material income misappropriation”

Or theft as it’s generally known. This is thought to be a separate issue to the missing £165k in Markets. More news on this as we get it …

And the response to this theft of our money?

“Action plan under development”

Because that’s what you do when you realise a load of money’s been nicked isn’t it? Obviously you don’t report it to the police and try and catch the culprits …

“Payroll – OF CONCERN”

Yep. You read that correctly. Even the payroll’s fucked.

“Direct Payments – OF CONCERN”

The system of handing money over to health and social care clients to buy their own services is, predictably, in chaos

“Administration of Imprest [ie. cash] Account – Identified areas of noncompliance”

More bent managers running dodgy financial systems open to embezzlement. Now why would they do that?

Significant number of fraud referrals during first quarter is concerning

Yes, it’s actually getting worse folks … Full report here (pdf).